They never had the balls to go short, much easier to chirp than actually put your money upThey too busy covering their short positions.

I think one thing driving the Tesla stock price is the absolute failure of the "Tesla killers" that were recently released. The Porsche Taycan, Volvo Polestar, Jaguar I-Pace, whatever "icar" bmw is on now. They all just suck compared to Tesla's offerings. People are starting to realize that the legacy car manufacturers have no idea how build a good electric car. If you think ev's are the future what company do you invest in right now?

Colleges

- American Athletic

- Atlantic Coast

- Big 12

- Big East

- Big Ten

- Colonial

- Conference USA

- Independents (FBS)

- Junior College

- Mountain West

- Northeast

- Pac-12

- Patriot League

- Pioneer League

- Southeastern

- Sun Belt

- Army

- Charlotte

- East Carolina

- Florida Atlantic

- Memphis

- Navy

- North Texas

- Rice

- South Florida

- Temple

- Tulane

- Tulsa

- UAB

- UTSA

- Boston College

- California

- Clemson

- Duke

- Florida State

- Georgia Tech

- Louisville

- Miami (FL)

- North Carolina

- North Carolina State

- Pittsburgh

- Southern Methodist

- Stanford

- Syracuse

- Virginia

- Virginia Tech

- Wake Forest

- Arizona

- Arizona State

- Baylor

- Brigham Young

- Cincinnati

- Colorado

- Houston

- Iowa State

- Kansas

- Kansas State

- Oklahoma State

- TCU

- Texas Tech

- UCF

- Utah

- West Virginia

- Illinois

- Indiana

- Iowa

- Maryland

- Michigan

- Michigan State

- Minnesota

- Nebraska

- Northwestern

- Ohio State

- Oregon

- Penn State

- Purdue

- Rutgers

- UCLA

- USC

- Washington

- Wisconsin

High Schools

- Illinois HS Sports

- Indiana HS Sports

- Iowa HS Sports

- Kansas HS Sports

- Michigan HS Sports

- Minnesota HS Sports

- Missouri HS Sports

- Nebraska HS Sports

- Oklahoma HS Sports

- Texas HS Hoops

- Texas HS Sports

- Wisconsin HS Sports

- Cincinnati HS Sports

- Delaware

- Maryland HS Sports

- New Jersey HS Hoops

- New Jersey HS Sports

- NYC HS Hoops

- Ohio HS Sports

- Pennsylvania HS Sports

- Virginia HS Sports

- West Virginia HS Sports

ADVERTISEMENT

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla - exited short sale

- Thread starter blion72

- Start date

We’re talking about Tesla, not the green new deal. Try and stay on topic

Tesla is just a car without a gas cap. No more. No less.

Tesla has certainly surprised me. I'm surprised that they were able to deliver 90k cars during Q2 with the Covid shutdown which is reasonabley flat compared to the prior 2 quarters.I guess the luddites dont want to talk about Tesla anymore

@Pinkhippo PeanutButter

@m.knox

@blion72

@83wuzme

The real question is if they can produce and sell these cars profitably. IIRC they've had 3 consecutive slightly positive quarters but that was only because of their ability to sell carbon (ZEV) credits to traditional auto manufactures.

and they start delivering the Model Y, which is an upscale Model 3 with a hatchback and reclinable rear seats. Then the truck, which I don't really like, after that.Tesla has certainly surprised me. I'm surprised that they were able to deliver 90k cars during Q2 with the Covid shutdown which is reasonabley flat compared to the prior 2 quarters.

The real question is if they can produce and sell these cars profitably. IIRC they've had 3 consecutive slightly positive quarters but that was only because of their ability to sell carbon (ZEV) credits to traditional auto manufactures.

But there is a lot of competition coming. Nissan has a really nice e-SUV that is rumored to be about $10k less.

Tesla has certainly surprised me. I'm surprised that they were able to deliver 90k cars during Q2 with the Covid shutdown which is reasonabley flat compared to the prior 2 quarters.

The real question is if they can produce and sell these cars profitably. IIRC they've had 3 consecutive slightly positive quarters but that was only because of their ability to sell carbon (ZEV) credits to traditional auto manufactures.

The real question is if they can produce and sell these cars profitably. IIRC they've had 3 consecutive slightly positive quarters but that was only because of their ability to sell carbon (ZEV) credits to traditional auto manufactures.

Why is that going to change for the worse? The more cars Tesla sell the more ZEV and other environmental credits they earn. Since these credits are essentially worthless to Tesla since they sell zero gasoline cars they can sell all of them.

You never really go into details on why these credits earned by legacy car manufactures are worth far more than the ones Tesla sells. Maybe biased a bit towards fossil fuels?

It will be interesting to see if Ford can deliver the electric F-150 by 2022.and they start delivering the Model Y, which is an upscale Model 3 with a hatchback and reclinable rear seats. Then the truck, which I don't really like, after that.

But there is a lot of competition coming. Nissan has a really nice e-SUV that is rumored to be about $10k less.

What ZEV credits do legacy car manufacturers earn?The real question is if they can produce and sell these cars profitably. IIRC they've had 3 consecutive slightly positive quarters but that was only because of their ability to sell carbon (ZEV) credits to traditional auto manufactures.

Why is that going to change for the worse? The more cars Tesla sell the more ZEV and other environmental credits they earn. Since these credits are essentially worthless to Tesla since they sell zero gasoline cars they can sell all of them.

You never really go into details on why these credits earned by legacy car manufactures are worth far more than the ones Tesla sells. Maybe biased a bit towards fossil fuels?

I agree that Tesla should become more efficient producing existing cars over time. The question is if they'll become efficient enough to consistently generate profits without ZEV credits. That's the key to profitable sales in the 38 states that don't participate in that program. Also, competitors won't be buying those credits if/when they transition to electric vehicles (which is probably a few years off).

What ZEV credits do legacy car manufacturers earn?

I agree that Tesla should become more efficient producing existing cars over time. The question is if they'll become efficient enough to consistently generate profits without ZEV credits. That's the key to profitable sales in the 38 states that don't participate in that program. Also, competitors won't be buying those credits if/when they transition to electric vehicles (which is probably a few years off).

What ZEV credits do legacy car manufacturers earn?

You think Tesla is the only car manufacturer that earns ZEV credits? Wow no wonder.

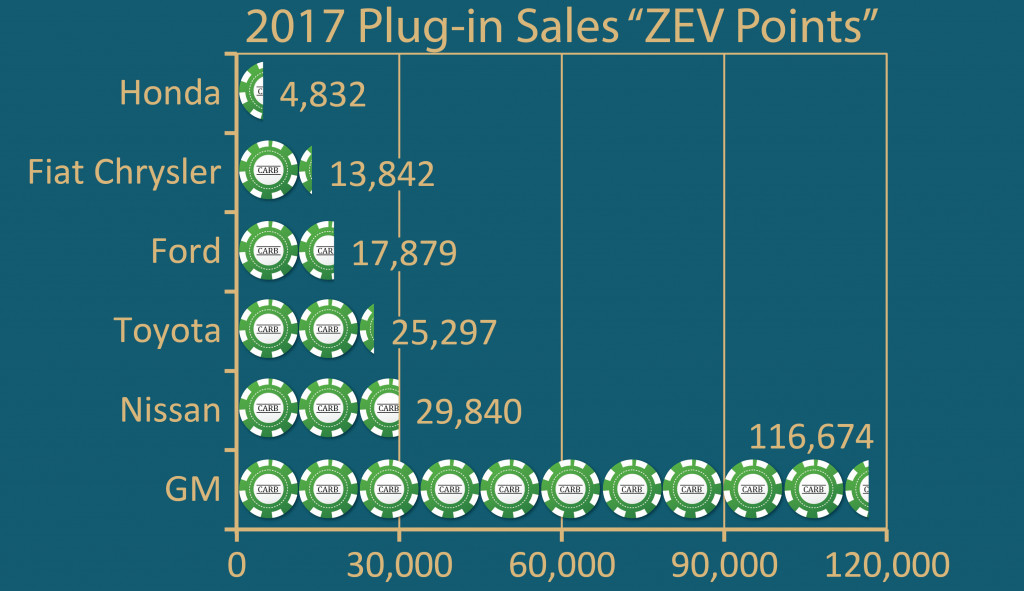

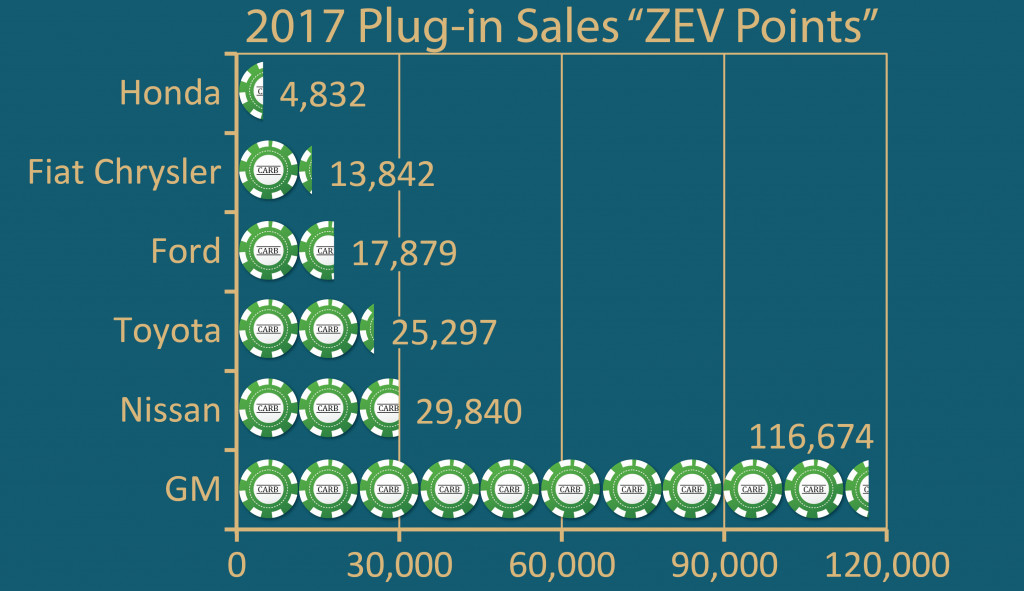

This is from 2017:

You don’t realize that you’re actually making the Tesla bull case every time you talk about these competitors that are on the way. Why would Ford and Nissan put so much effort into trying to get teslas small market share? Well they wouldn’t. The reality is the market is changing and these manufacturers realize that, and realize that if they don’t start producing electric vehicles Tesla will continue to eat into their ICE vehicle sales. So they might as well start making them themselves which cannibalizes their own ICE vehicle market salesIt will be interesting to see if Ford can deliver the electric F-150 by 2022.

What ZEV credits do legacy car manufacturers earn?

I agree that Tesla should become more efficient producing existing cars over time. The question is if they'll become efficient enough to consistently generate profits without ZEV credits. That's the key to profitable sales in the 38 states that don't participate in that program. Also, competitors won't be buying those credits if/when they transition to electric vehicles (which is probably a few years off).

I agree that Tesla should become more efficient producing existing cars over time. The question is if they'll become efficient enough to consistently generate profits without ZEV credits. That's the key to profitable sales in the 38 states that don't participate in that program. Also, competitors won't be buying those credits if/when they transition to electric vehicles (which is probably a few years off).

ZEV credits are worth a lot more to the legacy manufactures than they are to Telsa.

Since GM sells gasoline powered cars they must generate a certain amount of ZEV credits to offset those sales. Every credit GM earns is worth 5,000 dollars to them because they will be fined 5,000 for every credit they come up short. Tesla earns credits on every car they sell but they don't need any to offset fossil fuel car sales. So they can sell them to legacy manufactures. But they don't get 5,000 per credit like GM gets for ones they earn. From the limited data I have seen Tesla has sold the credits for anywhere from 1,600 to 2,500.

It will be interesting to see if Ford can deliver the electric F-150 by 2022.

What is interesting is how many electric F-150's will they be able to deliver by 2022. Ford has a little problem. Do they make the electric F-150 superior to the gasoline powered F-150? If they do then who will want to buy the old tech gasoline F-150? If they kill those sales then they will need to produced 500k superior electric F-150's right away. How in the world are they going to do that?

The other option is to release an electric F-150 that is not as good as the gasoline powered truck. They will sell a few to people that really want a Ford and really want an electric truck but it won't eat into their bread and butter gasoline truck sales. They can slowly transition people over to the electric truck hopefully over 10-20 years.

The problem with the slow transition is that Tesla is coming out with it's own truck and they don't have to worry about keeping their legacy gasoline truck sales strong. They can just build the best electric truck they can and sell it to as many people as possible.

You don’t realize that you’re actually making the Tesla bull case every time you talk about these competitors that are on the way. Why would Ford and Nissan put so much effort into trying to get teslas small market share? Well they wouldn’t. The reality is the market is changing and these manufacturers realize that, and realize that if they don’t start producing electric vehicles Tesla will continue to eat into their ICE vehicle sales. So they might as well start making them themselves which cannibalizes their own ICE vehicle market sales

Why am I making the Tesla "Bull Case"?

Almost every car manufacturer is working to develop electric vehicles because they think either think that's what consumers want or because they think the government is going to increasingly tax conventional vehicles. Whatever the reason, they are headed in that direction.

It seems to me that Tesla will have increased competition in the EV space as the years go forward. I'm not sure how you equate more competition to being a "bull case".

The problem with the slow transition is that Tesla is coming out with it's own truck and they don't have to worry about keeping their legacy gasoline truck sales strong. They can just build the best electric truck they can and sell it to as many people as possible.

I agree that Ford will have to contend with cannabilizing their gas powered trucks but they're not going to do it by intentionally bringing and inferior electric version to market. That's just dumb.

Ideally the electric version will be good enough that they can charge a slight premium.

What's your point?What ZEV credits do legacy car manufacturers earn?

You think Tesla is the only car manufacturer that earns ZEV credits? Wow no wonder.

This is from 2017:

You keep talking about the legacy manufacturer competition like its a bad thing- its a good sign that the demand is there for them to put the effort into doing it. Competition is going to increase, but the pie is going to always be getting bigger as well.Why am I making the Tesla "Bull Case"?

Almost every car manufacturer is working to develop electric vehicles because they think either think that's what consumers want or because they think the government is going to increasingly tax conventional vehicles. Whatever the reason, they are headed in that direction.

It seems to me that Tesla will have increased competition in the EV space as the years go forward. I'm not sure how you equate more competition to being a "bull case".

And the long term winners will have to be able to manufacturer and sell the cars profitably without a built in advantage from the government. Tesla hasn't proven tthat they can do that. Traditional manufacturers have proven they can do that with gas vehicles but not with electric vehicles. We'll have to wait and see who comes out ahead. I'm not sure why you think that's such a controversial opinion.You keep talking about the legacy manufacturer competition like its a bad thing- its a good sign that the demand is there for them to put the effort into doing it. Competition is going to increase, but the pie is going to always be getting bigger as well.

When did I say that was controversial?And the long term winners will have to be able to manufacturer and sell the cars profitably without a built in advantage from the government. Tesla hasn't proven tthat they can do that. Traditional manufacturers have proven they can do that with gas vehicles but not with electric vehicles. We'll have to wait and see who comes out ahead. I'm not sure why you think that's such a controversial opinion.

The problem is you don't get to wait to find out who the winners are and then invest in their companies- you've missed the move. This thread started in August '19 when Tesla traded for $200 and many thought it was overpriced and gave a list of reasons why. Its going to close about $1200 today and none of the problems that have been brought up have actually been an issue. At some point, those that hate Tesla have to tip their cap and reassess their position. And this isn't all directed at you personally and I appreciate that you can have a good conversation about it

What's your point?

Legacy car manufactures earn ZEV credits, duh.

FWIW:When did I say that was controversial?

The problem is you don't get to wait to find out who the winners are and then invest in their companies- you've missed the move. This thread started in August '19 when Tesla traded for $200 and many thought it was overpriced and gave a list of reasons why. Its going to close about $1200 today and none of the problems that have been brought up have actually been an issue. At some point, those that hate Tesla have to tip their cap and reassess their position. And this isn't all directed at you personally and I appreciate that you can have a good conversation about it

- I've looked at Tesla from a business viability point of view more than from an investment point of view.

- Back when Tesla was trading in the $200-$400 range I talked about their lack of working capital being a threat. That was 100% legit and to Tesla's credit they renegotiated debt, raised capital with additional stock issue, renegotiated supplier terms, etc. They also streamlined their business and focused on things that would have a more immediate revenue impact.

- Tesla's working capital is finally positive but I don't think they're completely out of the woods. They still haven't proved their ability to sell cars profitably. Of course no other manufacturer has proved that either. It will be interesting to see how fast they come up to speed.

- I'm curious to see how well Tesla does in China. That might be a big opportunity because air pollution is a problem in cities of 25 million people. The government is providing big subsidies and the only major competition is BYD.

Very small amounts compared to what they need to be able to sell gas fueled vehicles in some states.Legacy car manufactures earn ZEV credits, duh.

Very small amounts compared to what they need to be able to sell gas fueled vehicles in some states.

Maybe they should build a decent electric and car a sell a lot of them? Nah, why bother? They can keep milking their dead end fossil fueled products for a lot quarters yet. They just need to spend more on advertising.

I don’t see a difference between analyzing business viability and investment- no one is investing in companies they think are going bankruptFWIW:

- I've looked at Tesla from a business viability point of view more than from an investment point of view.

- Back when Tesla was trading in the $200-$400 range I talked about their lack of working capital being a threat. That was 100% legit and to Tesla's credit they renegotiated debt, raised capital with additional stock issue, renegotiated supplier terms, etc. They also streamlined their business and focused on things that would have a more immediate revenue impact.

- Tesla's working capital is finally positive but I don't think they're completely out of the woods. They still haven't proved their ability to sell cars profitably. Of course no other manufacturer has proved that either. It will be interesting to see how fast they come up to speed.

- I'm curious to see how well Tesla does in China. That might be a big opportunity because air pollution is a problem in cities of 25 million people. The government is providing big subsidies and the only major competition is BYD.

How many quarters or years of profits do they have to deliver before you decide the business is viable? And what happens when we reach that point?

I don’t see a difference between analyzing business viability and investment- no one is investing in companies they think are going bankrupt

How many quarters or years of profits do they have to deliver before you decide the business is viable? And what happens when we reach that point?

It's going to be long, long time before bdgan admits he was wrong.

The lengths you Tesla lovers go to defend/support the company is amazing. I'm impressed withTesla's innovation and I hope they do well, but that doesn't make me blind to financial realities and competitive pressures.I don’t see a difference between analyzing business viability and investment- no one is investing in companies they think are going bankrupt

How many quarters or years of profits do they have to deliver before you decide the business is viable? And what happens when we reach that point?

When they had negative working capital and big quarterly losses I said that they're going to have to get profitable in a hurry and/or raise more money. The response I got was that profits were for companies that can't grow. Guess what? Tesla restructured their debt, issued new equity, and Musk told employees that layoffs and other cost cutting was necessary in order to make their products competitive with fossil fuels.

Now Tesla has positive working capital (barely) and they've stopped the losses. More than 100% of the profits reported over the past 3 quarters is due to the sale of ZEV credits. They've made a lot of progress but their PE ratio is still negative. The PE is over 300 based on forward looking earnings. The stock price is all based on huge profit growth that is not guaranteed.

I said that Tesla has a head start over their competitors and the China factory might turn out great for them, but neither they nor their competitors (which are coming) have proven and ability to sell EVs profitably without government programs. I'm just trying to present the facts and you guys respond like I told you there's no Santa Claus.

P.S. I always said that Tesla would continue in some form even if they ran out of cash. They might have been bought out or forced into a restructuring. I said that the intellectual property was too valuable to simply disappear.

The lengths you Tesla lovers go to defend/support the company is amazing. I'm impressed withTesla's innovation and I hope they do well, but that doesn't make me blind to financial realities and competitive pressures.

When they had negative working capital and big quarterly losses I said that they're going to have to get profitable in a hurry and/or raise more money. The response I got was that profits were for companies that can't grow. Guess what? Tesla restructured their debt, issued new equity, and Musk told employees that layoffs and other cost cutting was necessary in order to make their products competitive with fossil fuels.

Now Tesla has positive working capital (barely) and they've stopped the losses. More than 100% of the profits reported over the past 3 quarters is due to the sale of ZEV credits. They've made a lot of progress but their PE ratio is still negative. The PE is over 300 based on forward looking earnings. The stock price is all based on huge profit growth that is not guaranteed.

I said that Tesla has a head start over their competitors and the China factory might turn out great for them, but neither they nor their competitors (which are coming) have proven and ability to sell EVs profitably without government programs. I'm just trying to present the facts and you guys respond like I told you there's no Santa Claus.

When they had negative working capital and big quarterly losses I said that they're going to have to get profitable in a hurry and/or raise more money.

You said they would run out of cash and be forced to sell more stock to stay alive. That never happened.

100% FALSE!When they had negative working capital and big quarterly losses I said that they're going to have to get profitable in a hurry and/or raise more money.

You said they would run out of cash and be forced to sell more stock to stay alive. That never happened.

Why do you distort everything? I said that they couldn't survive without cash. No business can. I went on to say that they would have to do some combination of restructuring debt, issue new equity, cut expenses, and start making money. The fact is they did all of those things. That's when you replied that profits are for companies that can't grow. That was about the time when Musk sent a letter to employees talking about the need for profitability.

You're a fool rumble.

100% FALSE!

Why do you distort everything? I said that they couldn't survive without cash. No business can. I went on to say that they would have to do some combination of restructuring debt, issue new equity, cut expenses, and start making money. The fact is they did all of those things. That's when you replied that profits are for companies that can't grow. That was about the time when Musk sent a letter to employees talking about the need for profitability.

You're a fool rumble.

Here you go - > https://bwi.forums.rivals.com/threads/tesla-exited-short-sale.243163/page-2#post-4288845

I posted this response to you on August 31 2019.

"So when are you predicting they will run out of cash?"

You replied to my post.

"1 year but it won't come to that. More dilutive equity."

They were never forced to sell stock because they had run out of cash.

That’s all lovely, but again- what’s the endgame? When does Tesla get your blessing as a viable long term company?The lengths you Tesla lovers go to defend/support the company is amazing. I'm impressed withTesla's innovation and I hope they do well, but that doesn't make me blind to financial realities and competitive pressures.

When they had negative working capital and big quarterly losses I said that they're going to have to get profitable in a hurry and/or raise more money. The response I got was that profits were for companies that can't grow. Guess what? Tesla restructured their debt, issued new equity, and Musk told employees that layoffs and other cost cutting was necessary in order to make their products competitive with fossil fuels.

Now Tesla has positive working capital (barely) and they've stopped the losses. More than 100% of the profits reported over the past 3 quarters is due to the sale of ZEV credits. They've made a lot of progress but their PE ratio is still negative. The PE is over 300 based on forward looking earnings. The stock price is all based on huge profit growth that is not guaranteed.

I said that Tesla has a head start over their competitors and the China factory might turn out great for them, but neither they nor their competitors (which are coming) have proven and ability to sell EVs profitably without government programs. I'm just trying to present the facts and you guys respond like I told you there's no Santa Claus.

P.S. I always said that Tesla would continue in some form even if they ran out of cash. They might have been bought out or forced into a restructuring. I said that the intellectual property was too valuable to simply disappear.

What part of "it will never come to that" are you unable to comprehend?Here you go - > https://bwi.forums.rivals.com/threads/tesla-exited-short-sale.243163/page-2#post-4288845

I posted this response to you on August 31 2019.

"So when are you predicting they will run out of cash?"You replied to my post.

"1 year but it won't come to that. More dilutive equity."They were never forced to sell stock because they had run out of cash.

Furthermore they did all of the things I mentioned. You should learn how to read 10-Qs.

They don't need my blessing but they will need to be able to sustain profitability at some point. It's sort of the way business works.That’s all lovely, but again- what’s the endgame? When does Tesla get your blessing as a viable long term company?

They too busy covering their short positions.

I think one thing driving the Tesla stock price is the absolute failure of the "Tesla killers" that were recently released. The Porsche Taycan, Volvo Polestar, Jaguar I-Pace, whatever "icar" bmw is on now. They all just suck compared to Tesla's offerings. People are starting to realize that the legacy car manufacturers have no idea how build a good electric car. If you think ev's are the future what company do you invest in right now?

i will jump in. i covered my short a very long time ago. i do very well shorting stocks that move based on hype and momentum - particularly when i see people on a bandwagon believing in a single trend model. i have a PhD in engineering and have been around technology my entire life including VC funding....have seen a lot of hype. i short more than long because big bet trends in a long position take too long to turn profit. I am not betting on EV or not EV with Tesla - i could care less - it is just what makes the most money and how as stock is behaving in its situation. i was just betting that point in time it was a good short, but you have to get out before momentum happens - which is news oriented. i moved from Tesla to Uber, and milked that position. Unicorn stocks that come out bleeding money are my favorites.

regarding Tesla the car company, i have been around that industry to know it is tough to make money in that business. not sure what kind of profit per car and what volume would be needed now to justify Tesla valuation based on a PE that you would expect in a car company that is growing.

what is their current P/E, profitability less EV credits, market share in global car business, profit growth, etc. what does $2 gas to this market? we have all heard the stories like a self-driving virtual car where nobody owns but "subscribes" to a car/transportation service - i am not going to invest in a company that has been around for 10 years or more and still essentially a break even operation at best.

What part of "it will never come to that" are you unable to comprehend?

Furthermore they did all of the things I mentioned. You should learn how to read 10-Qs.

Furthermore they did all of the things I mentioned. You should learn how to read 10-Qs

They ran out of cash and were forced to issue stock? That never happened.

No you don’t. Anyone who knows anything about trading could read your OP in this thread and know you are not a traderi will jump in. i covered my short a very long time ago. i do very well shorting stocks that move based on hype and momentum - particularly when i see people on a bandwagon believing in a single trend model. i have a PhD in engineering and have been around technology my entire life including VC funding....have seen a lot of hype. i short more than long because big bet trends in a long position take too long to turn profit. I am not betting on EV or not EV with Tesla - i could care less - it is just what makes the most money and how as stock is behaving in its situation. i was just betting that point in time it was a good short, but you have to get out before momentum happens - which is news oriented. i moved from Tesla to Uber, and milked that position. Unicorn stocks that come out bleeding money are my favorites.

regarding Tesla the car company, i have been around that industry to know it is tough to make money in that business. not sure what kind of profit per car and what volume would be needed now to justify Tesla valuation based on a PE that you would expect in a car company that is growing.

what is their current P/E, profitability less EV credits, market share in global car business, profit growth, etc. what does $2 gas to this market? we have all heard the stories like a self-driving virtual car where nobody owns but "subscribes" to a car/transportation service - i am not going to invest in a company that has been around for 10 years or more and still essentially a break even operation at best.

Aren't you embarrassed by your dishonesty? Don't answer, it's a rhetorical question.Furthermore they did all of the things I mentioned. You should learn how to read 10-Qs

They ran out of cash and were forced to issue stock? That never happened.

Aren't you embarrassed by your dishonesty? Don't answer, it's a rhetorical question.

They are your words. I posted the link to the thread.

i am not going to invest in a company that has been around for 10 years or more and still essentially a break even operation at best.

Completely agree with you point for a company in an existing industry not upsetting the apple cart. Given the size of the boats (ICE to electric, self-driving, vehicle sharing, battery production, energy storage, etc.)they are attempting to turn, you might be off by a factor or better. I've always been concerned with Tesla's attempting to do too much, which puts it in the cross hairs of people that look at it as a normal car company.

Completely agree with you point for a company in an existing industry not upsetting the apple cart. Given the size of the boats (ICE to electric, self-driving, vehicle sharing, battery production, energy storage, etc.)they are attempting to turn, you might be off by a factor or better. I've always been concerned with Tesla's attempting to do too much, which puts it in the cross hairs of people that look at it as a normal car company.

Who wants to invest in a company trying to do too many great things?

They are your words. I posted the link to the thread.

No they aren't. I said that if Tesla continued down their current (at the time) path they would run out of cash in less than a year. I also clearly said that it would't come to that; that they would take action before getting to that point. I never once said that Tesla ran out of cash (first) which forced them to sell stock. You're a liar rumble.They are your words. I posted the link to the thread.

No they aren't. I said that if Tesla continued down their current (at the time) path they would run out of cash in less than a year. I also clearly said that it would't come to that; that they would take action before getting to that point. I never once said that Tesla ran out of cash (first) which forced them to sell stock. You're a liar rumble.

You did not respond as below then?

I posted this response to you on August 31 2019.

"So when are you predicting they will run out of cash?"

You replied to my post.

"1 year but it won't come to that. More dilutive equity."

"So when are you predicting they will run out of cash?"

You replied to my post.

"1 year but it won't come to that. More dilutive equity."

The two of you have a choice to make ...You did not respond as below then?

I posted this response to you on August 31 2019.

"So when are you predicting they will run out of cash?"

You replied to my post.

"1 year but it won't come to that. More dilutive equity."

continue this embarrassing back and forth which is going nowhere, or move on

whoever stops posting I will consider to have embarrassed themselves the least

but carry on, it is the internet

Similar threads

- Replies

- 8

- Views

- 192

- Replies

- 0

- Views

- 111

- Replies

- 13

- Views

- 246

- Replies

- 0

- Views

- 895

ADVERTISEMENT

Latest posts

-

Football ESPN's SP+ is Very High On Penn State Entering 2025

- Latest: Dylan Callaghan-Croley

-

ADVERTISEMENT